Analysts say America might be staring down a huge economic shock just weeks from now

Five years ago, when COVID-19 brought the world’s economy to a grinding halt, economists turned to unconventional tools—like mobility data and restaurant reservations—to track the disruption in real time. Now, as Washington’s aggressive tariff campaign against Chinese imports unfolds, analysts are once again embracing creative methods to measure the fallout. So far, America’s economic engine is still running. But signs of strain are building.

Before many of the new tariffs officially took effect on April 9th, surveys indicated growing anxiety among American businesses and consumers. One poll from the Federal Reserve Bank of Dallas showed manufacturing output hit an all-time low in April. Meanwhile, fresh numbers published on April 30th revealed that U.S. GDP shrank by 0.3% on an annualized basis. The trade deficit ballooned as firms scrambled to stockpile overseas goods before new levies took hold.

Unlike during the pandemic, many of the fast-response indicators used then are now obsolete or discontinued. Luckily, international trade remains highly visible. Cargo ships, often weeks away from their destination, transmit real-time location data and detailed manifests via satellite.

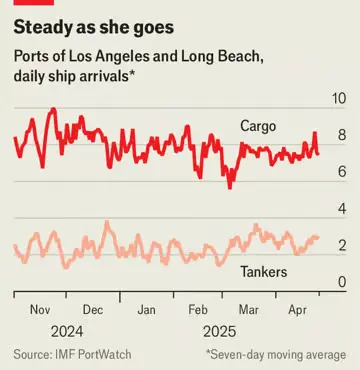

Some immediate metrics point to only modest disruption. In the week ending April 25th, ten cargo vessels carrying roughly 555,000 tonnes of imports arrived at the Los Angeles and Long Beach ports—the primary U.S. hubs for Chinese goods. That figure closely mirrors traffic from the same week a year ago. Still, these ships left port well before the new duties kicked in. The voyage from China to the U.S. West Coast typically takes two to six weeks.

Other indicators paint a darker picture. Vizion, a supply chain data company, reported a 45% year-over-year drop in bookings for trans-Pacific shipments during the week starting April 14th. Blank sailings—when carriers skip stops or reduce frequency—now account for 40% of scheduled trips. Freightos, a global freight marketplace, noted a $1,000-per-container decline in shipping costs between Shanghai and Los Angeles over the past month, reflecting a shift from pre-tariff hoarding to avoidance altogether. Meanwhile, shipping prices from Vietnam to the U.S. have jumped by a similar margin, suggesting companies are rapidly shifting their sourcing strategies.

The economic effects of trade disruptions take time to filter through. For now, firms are leaning on stockpiled inventory. Demand for bonded warehouses—storage facilities near ports where importers defer customs payments—has soared. Many companies are also keeping retail prices stable, despite supply pressure, due to long-term contracts or the desire to maintain customer loyalty in the event that “Mr Trump changes his mind.” The administration’s 90-day postponement of some of the harshest tariffs affecting other Asian countries offers companies a brief window to adjust. Apple, for instance, is ramping up iPhone production in India to offset dependency on China.

But supply chains can only bend so far. Research on the more moderate tariffs from Trump’s previous term found that U.S. consumers ultimately bore the full cost. Businesses typically needed a year to reorient to new suppliers. Peter Sand of Xeneta, a freight intelligence firm, says Trump’s unpredictable trade tactics have blindsided many logistics firms—despite years of turmoil that included a global pandemic, Suez Canal blockages, and Houthi strikes in the Red Sea. At a Port of Los Angeles board meeting on April 24th, the director warned that “temporary reprieves are too brief for many companies to rejig their procurement.” He added that the disruptions could still ripple through the economy even if the U.S. pulls back its harshest policies. Missed sailings will delay or erase deliveries. Inventory buffers will thin. Business investment and hiring decisions already on ice may be slow to thaw.

Could these economic strains trigger a backlash at the ballot box? Those betting on such an outcome may be disappointed. In a recent study, David Autor of MIT and collaborators found that most communities hit hardest by Trump-era tariffs actually grew more Republican in the aftermath. Their analysis suggests that many voters viewed economic pain as the price of taking a stand against China. “Confront” is the word they used.

The American economy hasn’t collapsed under its own trade offensive—yet. But the latest signals from the shipping sector offer little reassurance. The horizon looks turbulent. ■