Trump freezes $300bn in clean energy funds, jeopardizing US infrastructure plans

Donald Trump’s return to the White House has placed over $300 billion in federal infrastructure funding in jeopardy, unsettling U.S. investors. His administration wasted no time dismantling Joe Biden’s climate policies, halting critical disbursements to manufacturers and developers within hours of his inauguration.

The affected funds stem from Biden’s Inflation Reduction Act and bipartisan infrastructure law, including nearly $50 billion in Department of Energy loans already approved and another $280 billion in pending requests. “All agencies shall immediately pause the disbursement of funds appropriated” under these laws, the Trump administration declared in an executive order ominously titled “Unleash American Energy.”

Major projects now hang in the balance, such as a $9 billion conditional loan to Michigan’s DTE Energy and a $3.5 billion loan to Oregon-based PacifiCorp. While PacifiCorp stated it is working with the department on loan conditions, DTE has remained silent.

Analysts warn that projects reliant on grants and loan guarantees tied to Biden’s policies face slim chances under Trump. Rob Barnett of Bloomberg Intelligence remarked, “It’s going to be very hard to see that money go out the door under the Trump administration.”

The executive order was one of many issued in a late-night flurry after Trump was sworn in, marking his commitment to obliterate Biden’s “Green New Deal” and reinvigorate fossil fuel production. The clean energy sector was shaken, facing a clear signal of Trump’s intent to dismantle Biden’s industrial policies.

Shay Natarajan of Mobility Impact Partners highlighted the potential consequences, stating that federal support for EV and battery production will become scarce, heightening the risk of financial losses for ongoing projects. The infrastructure law allocated $1.2 trillion to transportation improvements, while the IRA provided $370 billion in tax credits, grants, and loans.

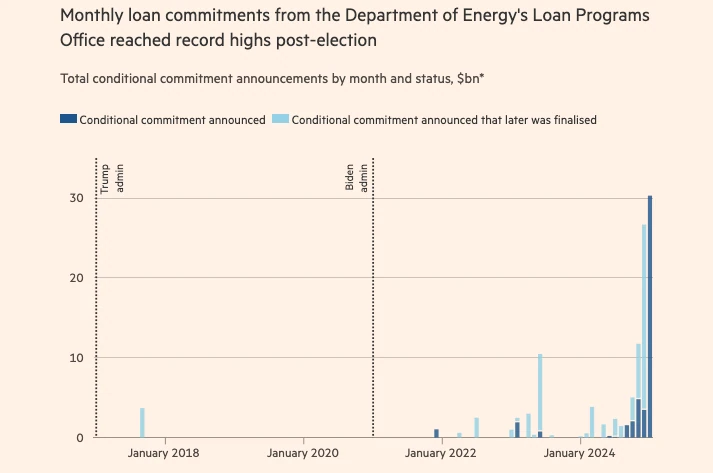

The Department of Energy’s Loan Programs Office, responsible for disbursing $400 billion, has long been a Republican target. Investors fear another $300 billion in future infrastructure funding could face a similar fate.

However, Biden’s IRA tax credits may remain untouched, as they represent the primary source of investment incentives. Since the law’s passage, manufacturers have pledged over $130 billion in investments, underscoring its importance.

Anticipating Trump’s moves, Biden officials rushed nearly $50 billion in loan approvals before he left office. Yet, Trump’s aggressive stance extends beyond loans, as he aims to halt wind farm construction on federal lands and abolish “unfair subsidies” for electric vehicles. The fallout has been immediate, with Tesla, Rivian, and wind energy giant Ørsted suffering stock declines.

The repercussions have spread, with Italy’s Prysmian Group canceling plans for an offshore wind cable factory in Massachusetts. RWE, a German energy giant, had already scaled back its U.S. wind ambitions ahead of Trump’s victory. Nearly 25GW of U.S. offshore wind projects, representing 65% of current capacity, are unlikely to advance under Trump, according to Rystad Energy.

In addition to these setbacks, Trump’s executive orders have frozen $7.5 billion in EV charging infrastructure funds from Biden’s Infrastructure Investment and Jobs Act. Legal experts suggest that Trump may face challenges in stopping these programs entirely, as it could violate the Impoundment Control Act of 1974. Meanwhile, states like California and New Jersey continue pushing forward with offshore wind projects despite federal opposition.

Public sentiment on Trump’s policies remains divided. A recent AP-NORC poll found that while some Americans support his energy strategy, widespread opposition exists against many of his top priorities, potentially complicating their implementation.

Some may argue that halting energy production amid an ongoing energy crisis defies logic, warning that “nothing will ever make sense again.” Ironically, much of the halted funding impacts projects in Republican-led states. Despite this, many expect Biden to shoulder the blame as political narratives unfold.

Eli Hinckley of Baker Botts warned that the perceived instability in U.S. investment could have severe long-term consequences, stating, “When you start to make it look like there’s a lack of stability in the investment that you thought you were making into the U.S., that has a potentially very negative effect, long term, on our ability to attract capital.”

Image Credits: Unsplash